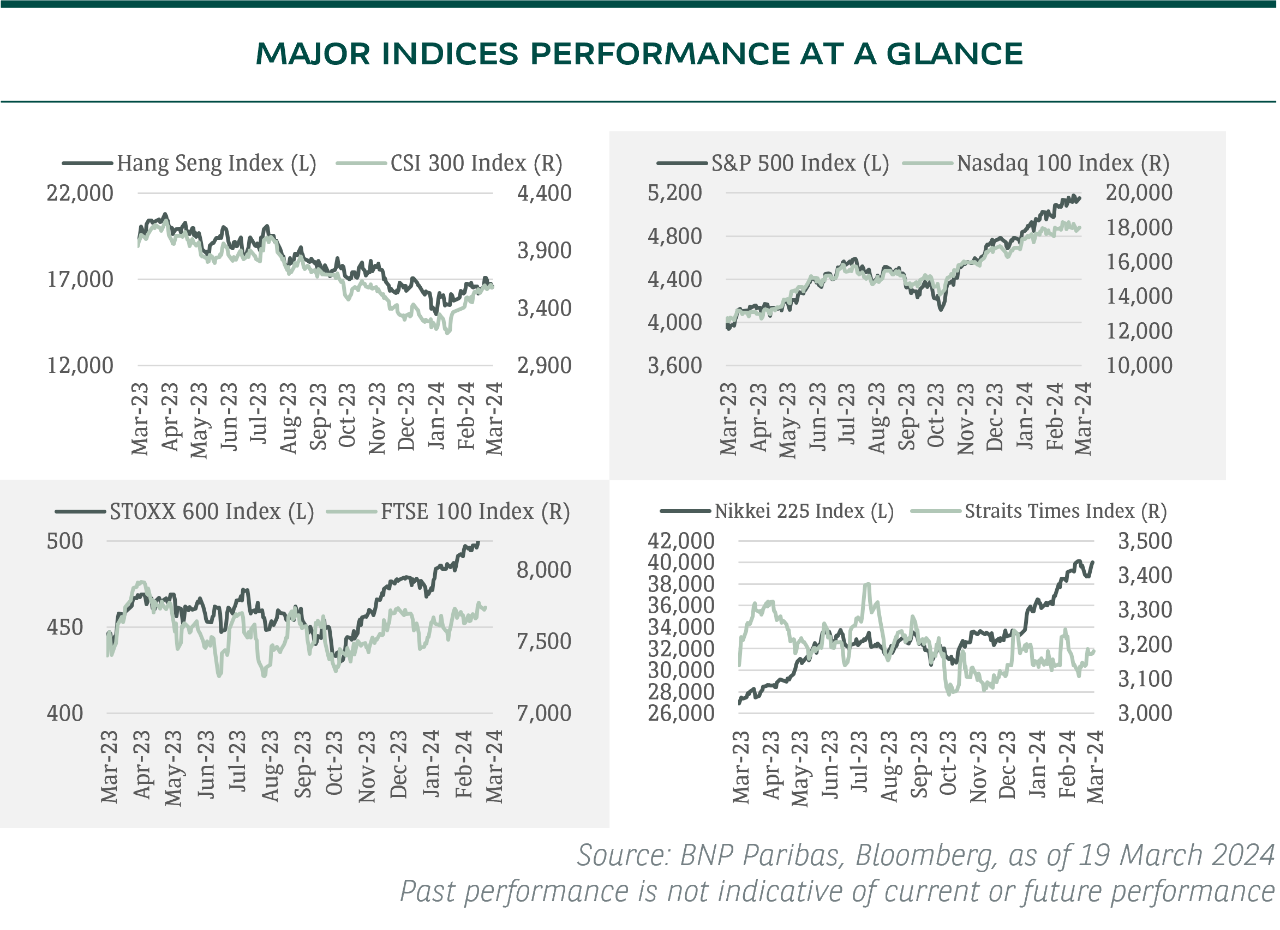

US continues to outperform world equities, with main indexes hit new closing highs after the Federal Reserve reassured investors about the timing of rate cuts.

Like the US, Europe’s equity market is dominated by a small group of internationally exposed quality growth companies. They benefit from strong earnings growth, low volatility, high & stable margins and strong balance sheets.

In Asia, Chinese equities saw a strong rebound in February 2024, following more concerted efforts taken by the authorities to stoke optimism and curb the current weakness in China. The People's Bank of China (PBoC)’s surprise move to lower the 5-year LPR signaled more proactive policy support for the weak property market.

As expected, the Bank of Japan has ended the negative interest rates era, while providing a dovish tone of keeping an accommodative stance, which lifted sentiment in the equity market.

HK / China: Gearing for the Long Game

Hong Kong and mainland China stock markets have finally showed early signs of life.

What happened?

Many Hong Kong and mainland China investors have shown appetite for high dividend yield large-caps, while they remain heedful for fading technical rebound.

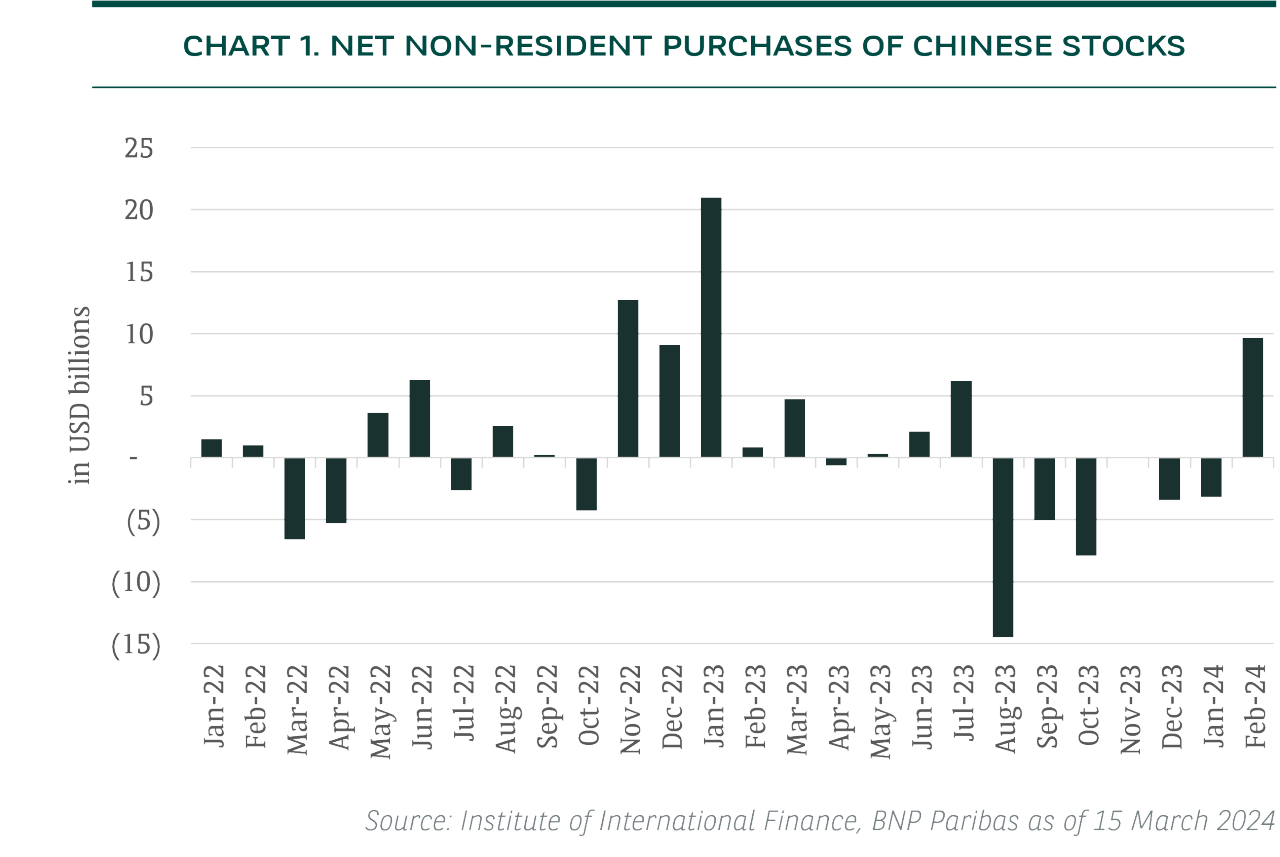

Non-locals looked for bargain purchase that non-resident net purchase of Chinese stocks rebounded to the highest level in a year (see Chart 1).

Our view

Hong Kong China stocks may find solid downside supports amid depressed valuation to both its own track record and to other major Asian markets.

We hold to our view that the eventual market revival is likely to be triggered by synchronised stimulus that are bold enough to restore business confidence. However, little has changed on the policy front in the past two months in our view.

Potential headwinds:

Politicians may be tempted to incubate hostile diplomatic policies, which would be intermittent market overhangs in the months ahead in the biggest year of election, e.g. the US biosecurity bill, European Union’s special tariff on Chinese-made electric vehicles and potential forced-sale of a China-based social media in the US.

How to play the game?

Advise to own |

Market share gainers and price-setters (such as online travel agency, consumer electronics, energy and telecommunication). |

Be mindful of |

The stocks vulnerable to sanction risks (including biotechnology, semiconductor, surveillance, aerospace technology, et cetera). |

Notable Developments in Selected Sectors

US: Starting 2024 on a Higher Note

US continues to outperform world equities driven by solid 4Q23 corporate reporting season, supportive financial conditions and expectations of the Fed’s upcoming rate cuts this year.

What happened?

Year to date (18 March 2024), MSCI US equities has outperformed World equities by ~1.1%, underscoring our expectation shared in our last publication for the market momentum to continue near term.

From a valuation perspective, the equity market last trades at ~19x forward price/earnings ratio (PER), which is close to +1 standard deviation to its past 10Y historical average multiple of ~17.5x.

The “Magnificent Seven” stocks have gained an average of +16.1% year to date, almost double that of MSCI US index’s +8.1% total returns, supported by continued positive sentiment driven by artificial intelligence (AI) and mostly solid 4Q23 results beat.

Our view

Earnings momentum remains key. After the solid 4Q23 corporate reporting season, consensus earnings growth estimates for MSCI US has been lifted to 9.4% for 2024E, higher than world equities’ 7.6% earnings growth expected.

Election uncertainties could also come further into focus in the second half of the year. It could translate to volatility for selected sectors that may be more sensitive to potential policy changes. Areas on our radar include healthcare policies, artificial intelligence (AI) regulation, energy permits, trade and tax policies.

While the equity market may stay extended for the near term, we believe there could be bouts of volatility and potential correction further down the road should expectations for inflation and growth in the US soften.

Over the past few months, we have started to see more dispersion in returns amongst the Magnificent Seven stocks. At the same time, investor flows have broadened to other sectors such as industrials, financials and healthcare over the past quarter, which we view as a healthier trend compared to the narrow concentration seen in 2023.

In terms of investment implications, we continue to advise investors to pay attention to core asset allocation and diversification of portfolio holdings.

How to play the game?

Top Performer |

Technology and communication services sectors, as the AI theme continued to drive investor flows into semiconductor and select AI exposed beneficiaries. |

Bottom Performer |

Utilities, materials and real estate. |

Notable Developments in Selected Sectors

Europe / UK: Europe Powers On

European markets hit record highs in March, despite having a far smaller exposure to the AI theme that has driven the US market, with fund manager survey data still suggesting buying appetite for the region.

What happened?

The market has performed well despite the macro challenges, notably for Germany. Although the region is suffering from weak economic growth, the unwinding of the energy price shock and the prospect of rates cuts are being taken favourably by investors.

The European Central Bank (ECB) has signalled June as the earliest date for an interest rate cut after it lowered its inflation forecast. The ECB also reduced its 2024 growth forecast for the fourth quarter in a row.

Our view

Europe

Earnings still a consideration. Europe reported its worst earnings season relative to the US in three years, with profits falling 11% in 4Q23, two percentage points more than analysts had expected.

Still, European stocks trade near a record discount to US peers (Stoxx 600’s 13.8x P/E compared to S&P 500’s 21.4x), discounting earnings momentum and the lower bias towards the AI story.

UK

Mixed earnings picture but plenty of value. Given its significant exposure to sliding commodity prices, the FTSE 100 was always facing a tough earnings picture.

4Q23 results showed a more broad-based decline across most major sectors, with Energy more than 10% lower and Financials off ~5%.

This, along with a lower exposure to the technology sector, is a reason why UK equities have lagged global peers year to date.

However, valuation remains a core part of the investment narrative. The UK currently trades near the bottom of its 30-year range in terms of P/E. The steep market discount has started to attract suitors in both public and private markets.

How to play the game?

European Market |

With leadership in growth areas like ESG and luxury goods, the European market can still act as an alternative to the US market when investors look beyond the technology sector. |

| UK Market | As a lower-beta value market that offers diversification, UK equities could benefit from a shift out of growth/momentum factors and a broadening out of the equity rally. |

Notable Developments in Selected Sectors